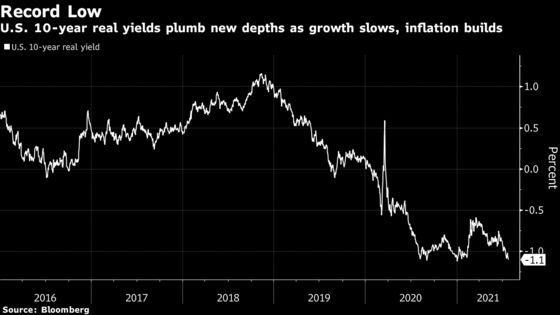

Real Yields Drop to Record Low, Investors Lap Up Inflation Debt

The real yield on U.S. 10-year debt fell to a record low as concerns grew over the outlook for economic growth.

(Bloomberg) -- The real yield on 10-year Treasuries fell to a record low as concerns mounted over the outlook for economic growth even as investor flows fueled appetite for inflation-linked debt.

The real rate, which strips out the expected impact of inflation over the next decade, fell as much as six basis points to minus 1.13%. The move was compounded by a lack of trading liquidity, with the 10-year breakeven rate -- a market proxy for the predicted average annual rate of consumer price gains over the next decade -- topping 2.41% Monday in the wake of substantial flows into the largest exchange-traded fund that’s tied to inflation bonds.

While the shift up in inflation expectations was substantial, the ongoing decline in real yields suggests investor sentiment is continuing to sour amid the rapid spread of the delta variant of the coronavirus that threatens to derail the economic recovery.

“We are in a regime of growth deceleration in the U.S., as the recovery becomes more mature and broad based, at the same time as inflationary pressures build,” said Peter Chatwell, head of multi-asset strategy at Mizuho International Plc.

Market jitters are building ahead of Wednesday’s Federal Reserve decision, when officials will discuss the outlook for further monetary stimulus. Traders are slashing forecasts for policy tightening into the meeting, even after inflation accelerated at the fastest pace in over a decade last month on an annual basis. The moves were also helped by investors piling into haven assets after a surprise hit to Germany’s business confidence.

Real yields could touch new lows if the Fed remains committed to keeping monetary policy unchanged, Michael Kushma, chief investment officer for Morgan Stanley Investment Management, said in an interview on Bloomberg TV.

“The more they push out their forward guidance of when they’re going to -- and how fast they’re going to -- raise rates, the more yields can stay low and, if inflation stays high, real yields can continue to remain very low,” he said.

Monday’s move follows a crackdown on the tech sector in China that temporarily sent 10-year Treasury yields down almost six basis points to 1.22% before closing a basis point higher on the day. Bund yields also rebounded, from a five-month low reached after a gauge by the Munich-based Ifo Institute fell to 100.8 from 101.7 in June. Economists in a Bloomberg survey had expected an improvement.

Record low real yields combined with a bounce in U.S. stocks futures later in the day also weighed on the dollar. Bloomberg’s dollar spot index closed down 0.2%.

Rally Overdone?

The German data fueled concerns about the economy’s ability to withstand the delta variant, but already there are concerns the latest advance looks overstated. Antoine Bouvet, senior rates strategist at ING Groep NV, said he wouldn’t touch German or U.S. debt “with a bargepole.”

“Carry in Treasuries has dropped and volatility has increased -- higher risk and lower return isn’t a winning combination,” he said.

Nevertheless the rally could have further to run. Bond supply is low during the summer months and demand from central banks is high, meaning investors may snap up whatever they can get.

The rally “feels overdone,” said Imogen Bachra, a strategist at NatWest Markets. “But we could be in this new range for a few weeks. Markets will want more evidence around the effectiveness of the vaccine and cases turning in the U.K. and Europe.”

©2021 Bloomberg L.P.